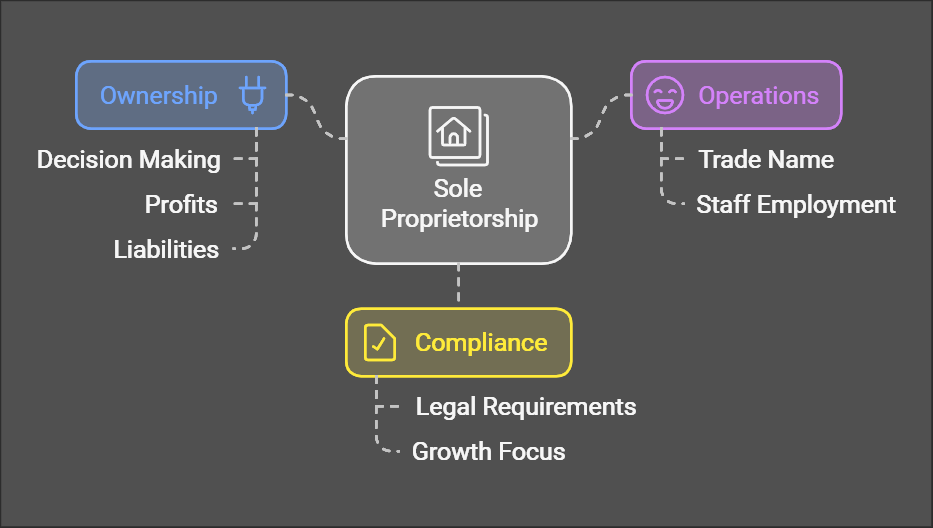

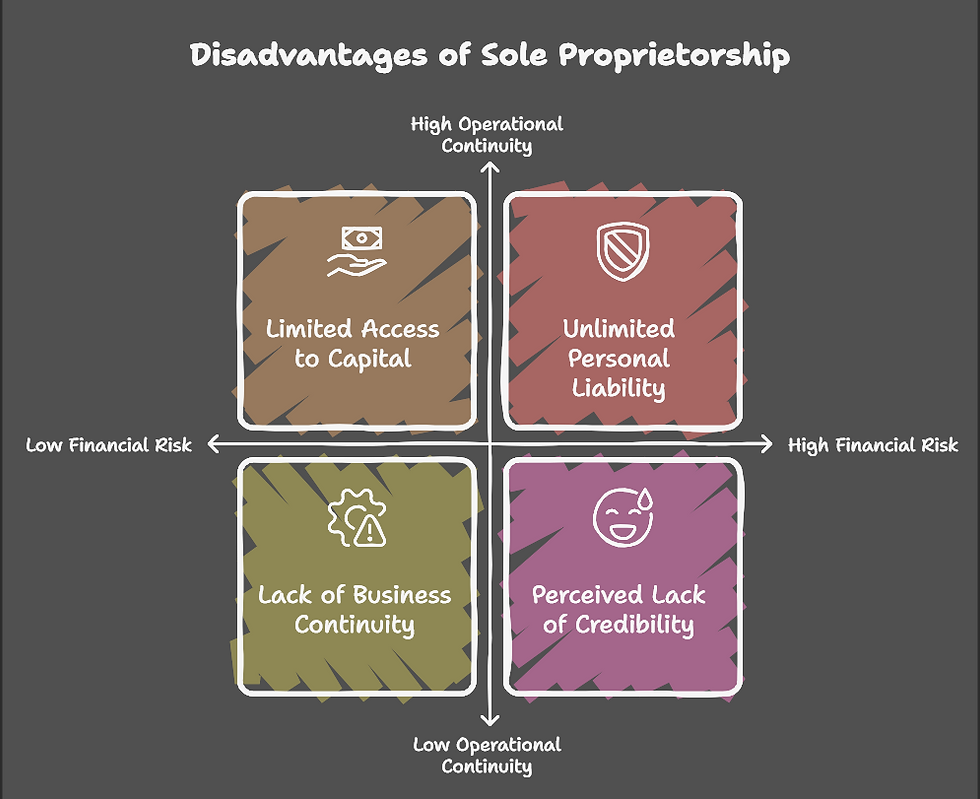

A sole proprietorship is the simplest and most widely chosen business structure, ideal for individuals seeking complete control over their business operations. It is owned and operated by a single individual and does not exist as a separate legal entity. As a result, the owner's personal and business assets are considered the same, making them personally liable for all debts and obligations of the business.

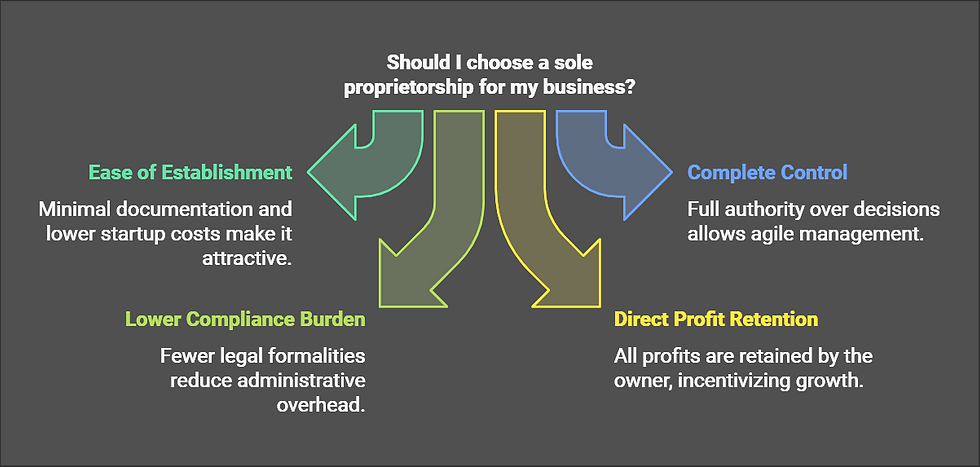

This structure is favored for its minimal regulatory requirements, ease of setup, and cost-efficiency, making it suitable for small-scale businesses, freelancers, and independent professionals. However, it is important to note the unlimited liability associated with this model, which may pose financial risks.

Get Expert Consultation

Our Process for One Person Company Registration

Step 1

Initial Form Submission

Begin the process by completing a simple form to provide the required basic details.

Step 2

Expert Consultation

Engage in a detailed discussion with our experts to assess your business's nature and operational scale.

Step 3

Documentation Preparation

Our professional team will draft and finalize all essential documents, including the Memorandum of Association (MOA), Articles of Association (AOA), and other necessary legal papers.

Step 4

MCA Compliance and Incorporation

The final stage involves completing all Ministry of Corporate Affairs (MCA) formalities to officially incorporate your company.

Why Choose Us

1

TRUSTED PARTNESR

1

1

Trademark Registrations

1

1

1

TRUSTED PARTNESR

TRUSTED PARTNESR

Company Incorporations

Happy Clients

1

TRUSTED PARTNESR

Customer Support Available

1

Customer Support

Business Consultations

24/7

FAQ'S

A sole proprietorship is a business structure owned and operated by one individual, where the owner and business are legally considered the same.

It offers full ownership and control, has minimal compliance requirements, and the owner is personally liable for all business debts.

It is cost-effective, simple to establish, and allows the owner complete decision-making authority.

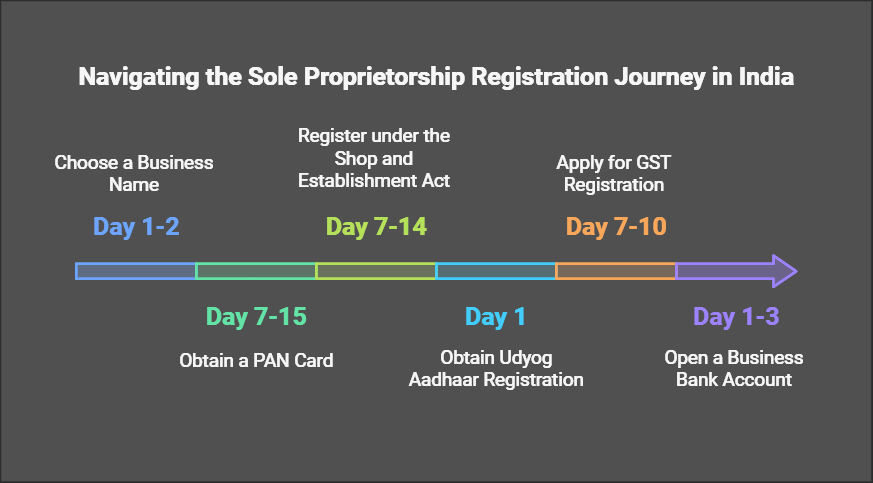

Depending on the business type, registrations like GST, Trade License, or Shop and Establishment Act compliance may be necessary.

It is best suited for freelancers, consultants, and small business owners who prefer a straightforward and low-risk operational model.

Proprietorship